What is Fundamental Analysis? Key Metrics for Stock Market Investing

Last week, we talked about how share investing is a powerful way to build wealth. But how do you know what shares to buy? That’s where fundamental analysis comes in—it’s stock market detective work. Today, we’re going to unmask what fundamental analysis is and how you can use it to analyze a stock even if you have no experience. This fundamental analysis for beginners guide will equip you with the essential knowledge to make informed investment decisions.

What Is Fundamental Analysis?

Fundamental analysis is a method of analyzing the financial well-being of a company to determine if its stock is a sound investment. It is similar to inspecting the engine of the car before buying it. Just as you would examine the engine and tires, fundamental analysis enables you to inspect the “engine” of the firm.

Instead of focusing on stock charts or short-term price movements, fundamental analysis looks at a company’s actual business performance. This focus on intrinsic value is the key difference between fundamental analysis vs. technical analysis, which we’ll cover later. We’ll be examining things like:

- How much money the company is making (revenue and profit)

- How efficiently it’s using its resources

- How much debt it has

- Its competitive position in the market – crucial for evaluating companies

Key Fundamental Analysis Metrics for Stocks

Let’s break down some of the most important financial ratios and metrics you’ll want to consider when performing fundamental analysis on a company:

- Revenue: This is the company’s total sales. A growing revenue is usually a good sign of business health.

- Profit Margins: This shows how much of each dollar earned translates into profit. Higher margins are generally better, indicating efficient operations.

- Debt-to-Equity Ratio: This indicates how dependent a firm is on debt relative to its own equity. Lower ratios typically signify smaller financial risks.

- Return on Equity (ROE): This indicates how efficiently a firm utilizes shareholders’ equity to produce profits. Higher ROE is generally better, reflecting better performance.

Example: Let’s say you’re considering two coffee companies as investments in the stock market. Company A is growing revenues, has good margins, and minimal debt. Company B has declining revenues and too much debt. Of the two, which company is a solid investment? Company A, of course! This quick fundamental analysis allows you to make that decision.

Why is Fundamental Analysis Important for Investors?

Fundamental analysis allows you to understand the actual worth of a company. Without it, you are essentially taking an educated guess based on price. Here’s why fundamental analysis is necessary for making informed investment decisions:

- Avoids Overhyped Shares: It is not always the case that a rising stock price means the company is doing well. Fundamental analysis allows you to verify whether the price is in accordance with the actual performance and financial health of the company.

- Highlights Undervalued Stocks: Great companies sometimes are undervalued in the stock market temporarily. Fundamental analysis can assist you in identifying such opportunities to buy low.

- Reduces Risk: Knowing a company’s financial condition, you can take informed decisions and steer clear of potential pitfalls with stock investment.

Real-World Example: In the 2000 dot-com bubble, internet firms had astronomical stock prices but no profits. The fundamental analysis would have indicated that most of these firms weren’t even valid businesses, something that was apparent when the bubble burst. This is a testament to the strength of fundamental analysis in protecting your investments.

How to Start Your First Fundamental Analysis

The best method for mastering the fundamentals of fundamental analysis is practicing using companies you are accustomed to. Here’s how you can begin with analyzing companies successfully:

- Choose a Publicly Traded Company: Start with a brand you know, like Apple ($AAPL$) or Starbucks ($SBUX$). Knowing how to research a company starts with familiarity.

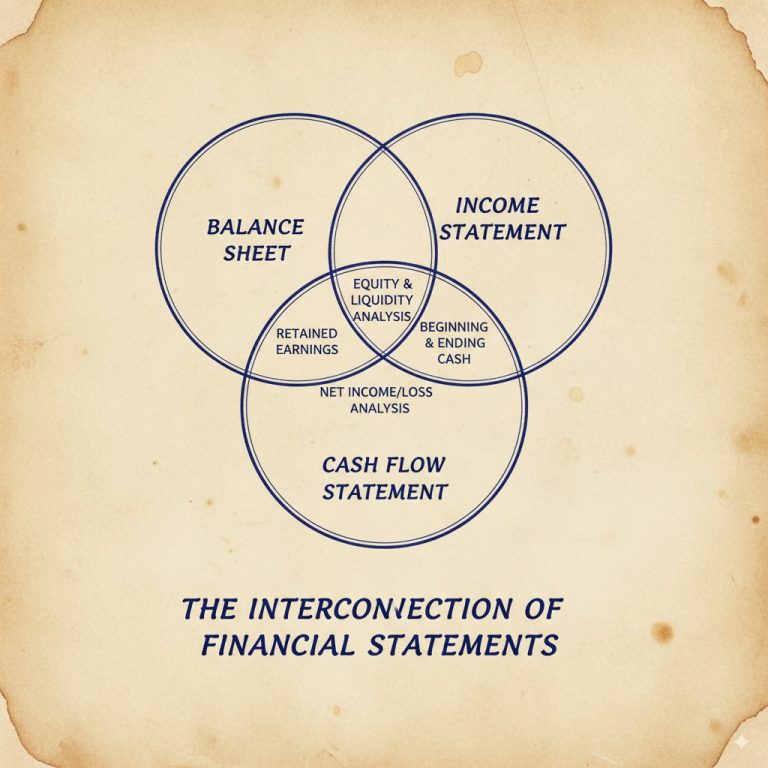

- Find Their Financial Statements: Go to the “Investor Relations” section of the company’s website to find their annual reports. Reading financial statements like the income statement, balance sheet, and cash flow statement is the core of fundamental analysis.

- Review the Metrics: Take a look at their revenue growth, profit margins, and debt load. How do they compare to comparable industry peers?

- Ask Tough Questions: Is the company growing? Are they making money? Do they have too much debt hanging over them? These questions drive good fundamental analysis.

Pro Tip: Use free resources like Investopedia’s Fundamental Analysis Guide to give your understanding of financial health and stock analysis an added foundation.

Conclusion

Fundamental analysis can seem intimidating, but it’s actually all about understanding how well a company is performing financially. By paying attention to key numbers like revenue, profit margins, and debt, you can make smarter investments. Remember that even an amateur can learn to evaluate companies like a pro with a little practice and determination.

In our next entry, we will cover in detail one of the most important financial statements: the income statement. Look out for how to interpret this precious document for full fundamental analysis!

Ready to start analyzing companies? Pick your favorite company and look up their financial statements today. And if you found this helpful, share it with a friend who is also interested in investing!