What Is a Cash Flow Statement? A Simple Guide for Investors

Introduction

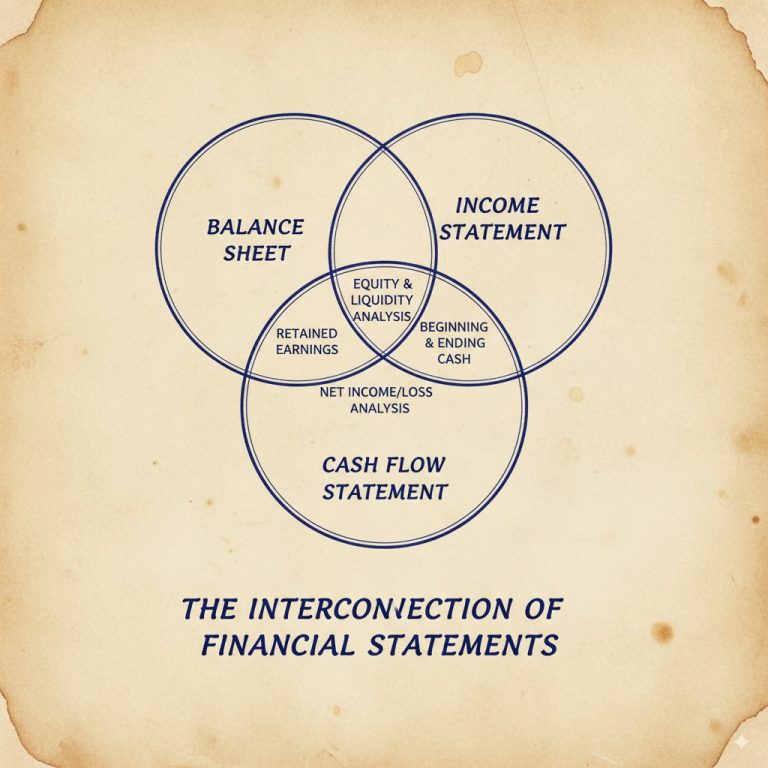

In our journey to understanding company financials, we’ve looked at the income statement and how it shows whether a company is making money. But there’s another critical document that tells an even more important story: the cash flow statement. So, what does this financial document truly reveal? While the income statement shows profit, the cash flow statement tracks the actual cash coming in and out, showing how a company generates and spends money.” (This adds a question that mimics a search query).

Think of it as the company’s “breathing”—without proper cash flow, even profitable companies can fail.

Cash Flow vs. Profit: A Critical Distinction

It’s one of the biggest myths of investing to confuse profit with cash flow. They aren’t the same. A business can report high net income on its income statement and still go bankrupt. The reason often lies in the difference between profit and actual cash flow. Why? Because profit includes non-cash items like depreciation, and it doesn’t account for working capital shifts (like bills owed or product inventories unsold).

For example, if a company sells $100,000 worth of products but hasn’t received the money from the customers yet, this is revenue and profit on the income statement. But on the statement of cash flows, it is zero cash inflow. The company might not have enough money to pay its bills even though it is “profitable.”

The 3 Core Components of a Cash Flow Statement

Every public company’s statement of cash flows is organized into three main sections:

- 1. Operating Activities: This is cash from the firm’s core business activities. It starts with net income from the income statement and is adjusted for non-cash items (e.g., depreciation) and working capital changes (e.g., accounts receivable and inventory).

- 2. Investing Activities: This is cash utilized for long-term investments, e.g., buying equipment or selling assets.

- 3. Financing Activities: This is cash from borrowings, repayments, dividend payments, or stock buybacks.

Analogy: Think of the cash flow statement as the firm’s bank statement. Operating activities are the everyday transactions, investing activities are big purchases or sales, and financing activities are loans or giving owners their profits.

Example: A company reports a net income (profit) of $50,000. This is the starting point for Cash Flow from Operations (CFO). If it also spends $30,000 on new equipment, that is a $30,000 cash outflow in Cash Flow from Investing (CFI). Even if its CFO is positive, this large investment will significantly impact its total cash balance.

Analyzing Positive vs. Negative Cash Flow

Positive cash flow means the company is taking in more cash than it’s losing. Negative cash flow is the opposite. And here comes the twist: negative cash flow isn’t always a bad thing. Companies sometimes spend money to grow, like when they buy new equipment or move into new markets.

Red Flags:

- One of the biggest red flags on a cash flow statement is consistently negative operating cash flow, as it suggests the core business is not generating enough cash to sustain itself.

- Large financing cash outflows (like paying high dividends) can signal financial distress.

Real-World Example: A start-up company might register negative cash flow for years as it invests in growth. Later, though, those investments can pay off in the form of higher future cash flows.

How to Analyze a Cash Flow Statement: A 3-Step Guide

When you read a cash flow statement, follow this step-by-step approach for a comprehensive analysis:

- 1. Look at Operating Cash Flow: Is it positive and growing? This indicates that the company’s core business is generating cash.

- 2. Analyze Investing Activities: Is the company investing in the future? Capital expenditures (like buying equipment) are typically a good sign.

- 3. Analyze Financing Activities: How is the company financing its operations? Relying too much on debt is risky.

Pro Tip: A key technique in cash flow analysis is to compare operating cash flow to net income. If Cash Flow from Operations consistently exceeds net income, it’s a strong indicator of high-quality earnings. If it’s less, look to find out why.

Conclusion

The statement of cash flows is your roadmap to a firm’s true financial health. Where the income statement shows profitability, the statement of cash flows informs you if the company has the liquidity to survive and expand. With operating, investing, and financing activities, you can spot opportunities and avoid danger.

In our next blog, we’ll explore the balance sheet and how it provides a snapshot of a company’s financial position. Stay tuned to learn how to read this crucial document!

Ready to analyze your first cash flow statement? Pick a company you’re curious about and look up their financials. Share your findings!